How cat insurance works

With a Healthy Paws pet insurance plan insuring your cat, you can visit any U.S. licensed veterinarian including the specialists and emergency animal hospitals that can truly make a difference in your pet’s care. The plan even covers alternative care.

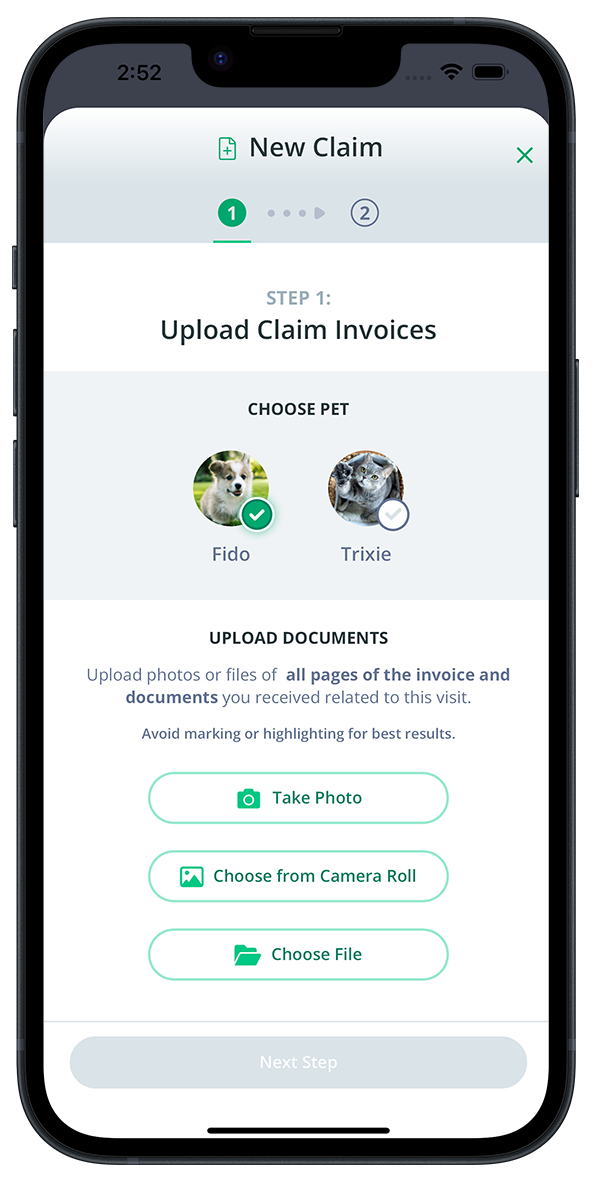

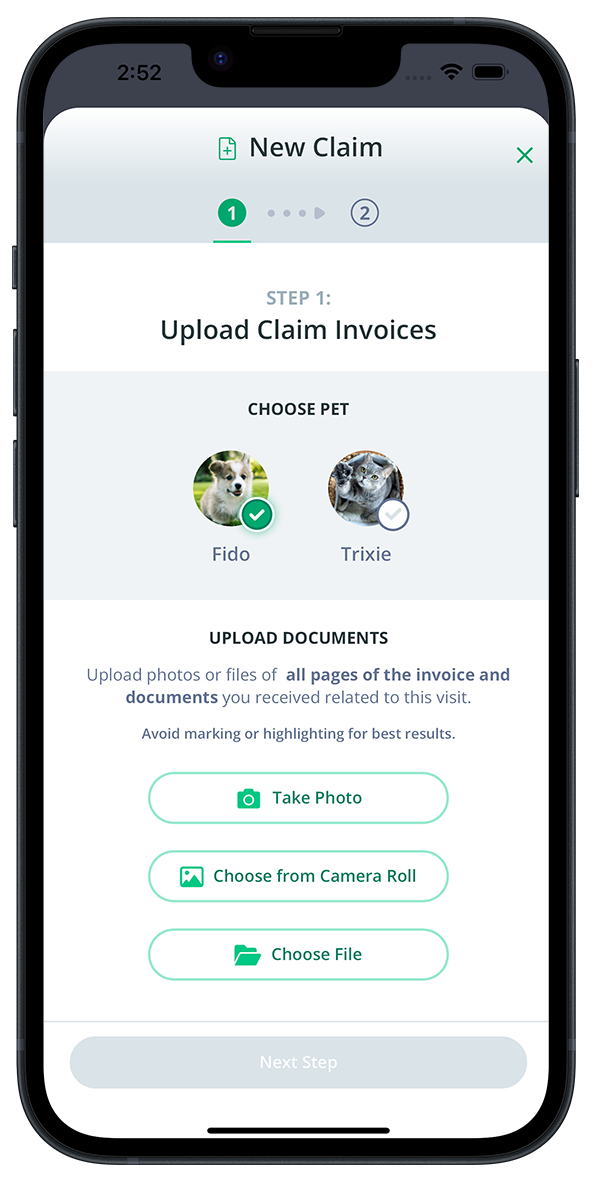

Cat insurance claims. Fast, easy, worry-free!*

- Visit any US licensed veterinarian or emergency clinic.

- Take a photo of your veterinarian bill & submit it via our app/website.

- Get money back. Most claims are processed within 2 days.

*When you file your first claim, we will need a copy of your pet’s full medical history.

See why nearly 100,000 cat parents trust Healthy Paws

Is cat insurance worth it?

Ryder, aka “trash cat”, loves to eat and this got him in trouble when he swallowed a piece of rubber. After numerous diagnostic tests, he needed surgery. When complications extended his hospital stay, his pet parents could rest easy knowing he was covered.

Condition: Ingested foreign object

Total Vet Cost

$7,774

The Healthy Paws Plan Reimbursed**

$5,969

Is cat insurance worth it?

Ryder, aka “trash cat”, loves to eat and this got him in trouble when he swallowed a piece of rubber. After numerous diagnostic tests, he needed surgery. When complications extended his hospital stay, his pet parents could rest easy knowing he was covered.

Condition: Ingested foreign object

Total Vet Cost $7,774

The Healthy Paws Plan

Reimbursed**

$5,969

"My cat has had a couple of surgeries in the last 3 years. They have always gotten my reimbursement checks to me very quickly (far faster than I would have imagined). The staff there is very kind, they are always asking how my cat is and checking up on us.”

- Jeff Z. on PetInsuranceReview.com

Cat health insurance – for kittens to seniors

When your cat gets too curious and needs emergency care or develops diabetes later in life that takes you both by surprise, the Healthy Paws plan can help you give your kitty companion the best medical care.

Insurance for kittens to five-year-old cats

Kittens and younger cats can get sick just as easily as older cats, experiencing illnesses like urinary tract and upper respiratory infections. Kittens are also incredibly curious and tend to eat things they shouldn't, like sewing needles and rubber bands.

Insurance for cats six years and older

As your cats gets older, they may be affected by a hereditary or congenital condition that could cost you a fortune if you don't have pet insurance. With a Healthy Paws plan, you'll be protected for the lifetime of their policy. Just enroll your "purry" friend up until their 14th birthday.1

Pet insurance for cats and kittens comparison

| What to Consider | Healthy Paws |

|

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Pet Insurance Review rating (PetInsuranceReview.com 2025) | 4.9 | 4.7 | 4.9 | 4.4 | 4.9 | 4.8 | 4.5 | 4.6 | 4.9 | 4.3 | 4.8 | 4.9 | |

| No limits on any plans: no per-incident, annual or lifetime caps on payouts |  |

|

|

|

|

|

|

|

|

|

|

|

|

| All new accidents and illnesses covered |  |

|

|

|

|

|

|

|

|

|

|

|

|

| No restrictions on hereditary and congenital conditions 2 |  |

|

|

|

|

|

|

|

|

|

|

|

|

| Alternative care included |  |

|

|

|

Only as an add-on | Limited | Limited |  |

|

|

|

|

|

| Deductible type | Annual | Annual | Annual | Annual | Annual | Annual | Annual | Annual | Annual | Annual | Annual and/or per condition | Per condition | |

| Compare ASPCA |

Compare Embrace |

Compare Figo |

Compare Lemonade |

Compare Nationwide |

Compare Pets Best |

Compare Met Life |

Compare Fetch |

Compare Pumpkin |

Compare Spot |

Compare Trupanion |

Included

Included

Not included or some exclusions

Not included or some exclusions

"Dealing with Healthy Paws Insurance is like dealing with a friend or family member. The service is very personal and it is exactly what a customer needs in times of trouble."

- Pascale on PetInsuranceReview.com

Common questions about cat insurance

What does cat insurance cover?

The Healthy Paws plan covers the costs of veterinary care to treat new injuries and illnesses, including diagnostic testing, treatment, surgery, and medications. Coverage includes (but is not limited to): cancer, emergency care, genetic and hereditary conditions, breed-specific conditions, and alternative care.2

When is the best time to buy cat insurance?

It's wise to enroll your cat in pet insurance as early as possible before any illnesses develop since pet insurance does not cover pre-existing conditions.

Can I use any veterinarian?

Yes! With Healthy Paws, you can take your cat to any licensed veterinarian in the U.S. or while traveling in Canada, including emergency vets and specialists.

Is routine care covered?

No, routine care is not covered. Although wellness care is an essential part of responsible pet parenting, there is a clear distinction between a wellness plan and pet health insurance. The Healthy Paws plan is meant to help cover unplanned veterinary visits, including diagnostics, treatment, and medication for injuries or illnesses that can quickly become very expensive and aren’t as easy to budget for. Routine healthcare includes vaccinations, flea control, heartworm medication, de-worming, dental care, ear plucking, grooming, and prudent regular care.

Are there any caps on payouts?

With Healthy Paws, there are no limits on claim payouts, per claim, per year, or for the lifetime of your policy, so you can get your cat the care they need without worrying about reaching plan limits.

**Example reimbursement amount based on covered treatments using a 80% reimbursement level and a $250 annual deductible.

1 Maximum enrollment age varies by state.

2 The Healthy Paws plan includes coverage for hip dysplasia when you enroll your pet before the age of six. Please review state-specific information regarding pet enrollment age and waiting periods for more details.

The claim scenarios described here are intended to show the types of situations that may result in claims. These scenarios should not be compared to any other claim. Whether or to what extent a particular loss is covered depends on the facts and circumstances of the loss, the terms and conditions of the policy as issued and applicable law. Insureds providing testimonials have not received compensation for their statements.